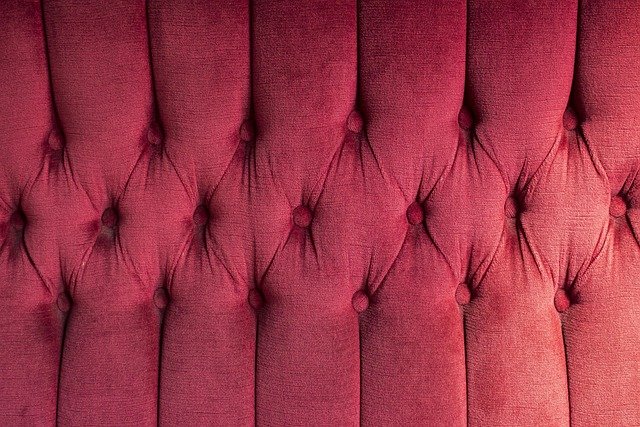

Your Dream Sofa Is Just One Click Away — No Credit Check. No Deposit. Just Comfort.

Who says luxury living has to wait? With modern Buy Now Pay Later Sofas no Credit Check no Deposit options, you can bring home the comfort and elegance you deserve right now — and take care of the payments later. Whether you're furnishing your first apartment or upgrading your home, flexible sofa financing makes style and convenience accessible for everyone.Even with bad credit or no credit history, today’s sofa financing solutions offer quick approvals and stunning selections. Enjoy the confidence of knowing that Buy Now Pay Later for Sofas programs are designed with your life in mind — no deposit, no stress, just premium comfort.

Why Wait? Bring Home Luxury Sofas Now, Pay Over Time

The traditional furniture buying process often requires substantial upfront investments that can strain budgets and delay home improvements. Buy now, pay later sofa programs eliminate these obstacles by offering immediate possession with deferred payment schedules. These arrangements typically divide the total cost into equal installments over periods ranging from three months to several years, depending on the retailer and financing partner.

Most programs require only basic information for approval, including employment verification and bank account details. The application process usually takes minutes, with instant decisions allowing you to complete purchases immediately. This approach transforms furniture shopping from a major financial event into a manageable monthly expense that aligns with your existing budget structure.

Instant Comfort, Flexible Plans: How It Works

The mechanics of sofa financing programs are designed for simplicity and transparency. After selecting your desired sofa, you choose a payment plan that matches your financial preferences. Options typically include short-term plans spanning 3-6 months with zero interest, or longer-term arrangements extending up to 48 months with competitive rates.

Upon approval, you receive immediate access to your furniture while the financing company handles payment processing. Automatic deductions from your designated account ensure timely payments without manual intervention. Many programs also offer early payoff options without penalties, providing flexibility for customers whose financial situations improve.

Yes — You Can Get a Sofa With Bad Credit or No Cosigner

Traditional credit requirements often exclude customers with limited credit histories or past financial challenges. Modern sofa financing specifically addresses these gaps by focusing on current financial capacity rather than historical credit performance. Many programs perform soft credit checks that don’t impact your credit score, while others rely entirely on income verification and banking relationships.

Alternative data sources, including employment history, utility payments, and banking patterns, help lenders assess creditworthiness beyond traditional scores. This approach has opened furniture financing to millions of customers previously excluded from conventional lending, creating opportunities for individuals building or rebuilding their credit profiles.

What Types of Sofas Qualify for No Credit Check Financing

Most retailers offering buy now, pay later options maintain extensive inventories spanning various price points and styles. Qualifying furniture typically includes sectional sofas, loveseats, recliners, sleeper sofas, and complete living room sets. Price ranges accommodate different budgets, from basic models under $500 to premium leather sectionals exceeding $3,000.

Participating retailers often feature major furniture brands alongside their private label collections, ensuring customers access diverse design aesthetics and quality levels. Some programs extend beyond individual pieces to complete room packages, allowing comprehensive home furnishing through single financing arrangements.

Regional Furniture Market Insights for American Consumers

The United States furniture market has experienced significant growth in buy now, pay later adoption, with participation rates increasing over 300% since 2020. Regional preferences vary considerably, with urban markets favoring compact, multifunctional designs while suburban customers prefer larger sectional configurations. Local services often provide delivery and setup options that enhance the overall purchasing experience.

American consumers increasingly prioritize sustainable materials and domestically manufactured products, leading many financing programs to partner with eco-conscious brands. This trend has created opportunities for premium pricing on environmentally responsible furniture while maintaining accessible payment structures through flexible financing arrangements.

Comparing Major Buy Now Pay Later Sofa Providers

Understanding your financing options requires comparing available providers and their respective terms. The following comparison highlights major players in the furniture financing space:

| Provider | Financing Terms | Key Features | Typical APR Range |

|---|---|---|---|

| Affirm | 3-48 months | No hidden fees, prequalification available | 0-30% |

| Klarna | 4 payments or longer terms | Interest-free short-term options | 0-24.99% |

| PayPal Credit | 6-24 months | No interest if paid in full within promotional period | 19.99-26.99% |

| Progressive Leasing | 12 months lease-to-own | No credit required, early buyout options | Lease pricing varies |

| Snap Finance | 12 months | Decision in seconds, no credit needed | 36-47.99% |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Tips for Successful Sofa Financing

Maximizing your financing experience requires careful planning and realistic assessment of your financial capacity. Begin by measuring your space accurately to ensure proper furniture sizing, preventing costly exchanges or returns. Calculate total financing costs including interest and fees to understand the complete financial commitment beyond the advertised furniture price.

Read all terms carefully, paying attention to late fee structures, early payment policies, and return procedures. Many customers benefit from setting up automatic payments slightly before due dates to avoid potential processing delays that could trigger penalty charges.

Buy now, pay later sofa financing has democratized access to quality furniture, enabling millions of Americans to create comfortable living spaces without traditional financial barriers. These programs continue evolving to meet diverse consumer needs while maintaining responsible lending practices that protect both retailers and customers. The combination of instant gratification and manageable payments has fundamentally changed how people approach home furnishing decisions.